"Read This if You Want to Learn How to Remove IRS Form 990 Late-Filing Penalties for NONPROFIT Organizations"

Learn to Write an Effective Reasonable Cause Letter to the IRS Today

Don't waste your whole weekend trying to figure it out yourself!

Why my method and Sample Letters may be just what you're looking for:

|

David McRee, CPA |

|

"The IRS dropped all $22,000 in fines! Thank you so much for writing this informative and

well-written book!" |

|

| ---Patrick, Austin, TX | |

From the desk of David McRee, CPA:

Pretty scary isn't it? You work hard to do good and help people and this is the reward you get? Don't lose sleep over it! I can show you today how to have those penalties (and interest) removed.

Maybe you are like Mike, a CPA who prepared Form 990 for several local nonprofits at a very reasonable fee. Unfortunately, Mike's firm's due-date tracking system had a glitch and extensions for three of his nonprofit clients' 990's were not filed. By the time Mike discovered the error, they were on the hook for thousands of dollars in late filing penalties. Talk about embarrassment and stress!

Mike admitted to losing more than one night's sleep when the penalty notices appeared in the official IRS envelope. It was tough to admit to his nonprofit clients that he'd made such a mistake and he worried that he might have to use his liability insurance to pay the penalties.

| "I was devastated when one of our nonprofit clients received a $30,000 late filing penalty. With the help of your Form 990 Penalty Abatement e-book I was able to get the entire amount abated." | |

| --- L.I., Certified Public Accountant | |

Click Here to Buy the e-book, example letters, and instructional videos now.

Or, you may be in a situation like Anita, who came into a community nonprofit as the new treasurer. The outgoing treasurer, who had been quite ill, didn't file the prior year's Form 990 and didn't tell Anita that preparing Form 990 was part of her responsibility. Imagine her surprise when the IRS notices appeared in the mail. She called her own personal tax return preparer who told her that they'd just have to pay the penalties. (Wrong!)

Both Mike and Anita purchased my Form 990 Late-filing Penalty Manual ebook and used it to craft a letter which convinced the IRS that they qualified for penalty abatement under the "reasonable cause" provisions. They both experienced a huge relief when the letter came from the IRS showing that they no longer had to pay the penalties.

Don't waste any more of your time searching the internet until you've learned what I have to offer and how cost-effective it is. Your time is worth money.

I can't even count how many CPA's and Board members write to me saying that the letter they wrote on their own didn't work. The IRS rejected their abatement request.

But after writing a second letter using my method and my advice they were successful in having the penalties removed. Just have a look at some of the unsolicited testimonials I've received, further down this page.

You (or your CPA) can be successful in having the penalties waived by following the instructions in my Form 990 Penalty Relief Manual available as an e-book which includes access to nearly two hours of instructional videos.

Click here to buy the penalty manual, sample letters, and instructional videos now.

Click here now to buy the book, sample letters, and video instruction.

Be cautious about advice

that tells you that all you have to do is tell the IRS what a great organization you have and how paying

penalties will cause you to reduce charitable programs. That does nothing to establish "reasonable cause."

Simply dropping buzzwords like "no willful neglect," or "administrative oversight" often do not persuade

the IRS that you deserve abatement. While these cliches might work in the most simple cases, placing your

reliance on them can lead to disappointment or worse.

Be cautious about advice

that tells you that all you have to do is tell the IRS what a great organization you have and how paying

penalties will cause you to reduce charitable programs. That does nothing to establish "reasonable cause."

Simply dropping buzzwords like "no willful neglect," or "administrative oversight" often do not persuade

the IRS that you deserve abatement. While these cliches might work in the most simple cases, placing your

reliance on them can lead to disappointment or worse.

Have Questions? Need help? Contact me. Tell me about your situation.

David McRee, CPA. Florida CPA License #AC0031324

The IRS is serious about collecting penalties. I take penalties seriously and I provide the materials you need to convince the IRS you deserve abatement. I've written or reviewed and edited hundreds of Form 990 late-filing penalty abatement request letters with nearly 100% success.

Don't take the approach that "Well, it's worth a shot!" or "What have we got to lose by sending a letter?" Asking for penalty abatement is not gambling. It's not a poker game or a crapshoot.

Penalty abatement for reasonable cause is a provision in the tax code. Send a letter with a properly structured argument and your chances for abatement are very high if you have reasonable cause.

If you've already written a letter requesting abatement and the IRS has denied your request, the information in this e-book can help you figure out what you did wrong, possibly giving you a second chance at having your penalties abated if you act quickly.

In addition to my proven penalty manual, I'm also giving you access to example letters and a template you can use to structure your letter to the IRS.

The template and example letters are provided to you in the following file formats: .docx, .doc, .odt, and .rtf.

I'm also giving you access to two video webinars titled "What is Reasonable Cause?" and "Drafting Your Letter." The videos provide almost two hours of detailed instruction. Of course you don't HAVE to watch both videos in their entirety, but they are there if you need them or want to become an expert on reasonable cause.

Example Letters for Form 990 Penalty Abatement

My materials include the full text of twelve letters that were successful in having IRS penalties abated for reasonable cause. See exactly what a successful letter looks like. You will certainly find some parts of the letters that will apply directly to your situation. I've included several of my most recent successful letters. These letters got penalties abated in some very difficult circumstances. If I can do it, with the right knowledge, so can you. The letters will arrive in your email in Microsoft Word file format so you can copy and paste into your own letter when you find language that fits your situation.

Below is a summary of the situations the letters cover. There are paragraphs in the letters that cover almost every conceivable situation I've encountered in the last 15 years:

Letter #1 - A private school filed its Form 990 on time, but the IRS claimed it was filed late because it was received after the extended due date. We provided Certified Mail receipts showing that extensions were filed, and that the return was filed before the extended due date. We reminded the IRS of the law that "timely mailed is timely filed," regardless of what date the return is actually received. which the organization received a penalty.

Letter #2 - A small religious organization [501(c)(3)] filed incomplete Forms 990 for several years. It did not attach Schedule B as required. A CPA prepared the returns, but failed to follow through properly in response to IRS demands for the missing schedules.

Letter #3 - A 501(c)(6) organization had a CPA firm preparedand file their 990. Because of software issues, a paper return was filed instead of e-filing the return as usual. AFter two years passed, the IRS claimed to have never received the return and charged a penalty. We successfully argued that although there was no Certified Mail receipt, other evidence indicated that a return was, more likely than not, mailed timely.

Letter #4 - A private foundation with a prior instance of late filing of Form 990-PF received a late-filing penalty because their CPA failed to transmit an extension request. We showed that the CPA had administrative and software issues that caused them to miss the filing of the extension request.

Letter #5 - After dissolving and distributing its assets, a large public charity [501(c)(3)] filed its final, short-year return after the due date. Over one year late, in fact. Numerous circumstances contributed to the delinquency. The late-filing penalty, which was abated in its entirety, was nearly $50,000.

Letter #6 - A nonprofit school filed multiple years' Form 990 after the due date. It took over a year to correct the delinquency and a CPA firm was involved. The school's own attempt at an abatemen letter (following the instructions of the IRS agent) was rejected. This letter I wrote on their behalf resulted in the abatement of all penalties--about $20,000.

Letter #7 - A CPA failed to file a client's return on time due to some glitches in their due date tracking software. The first abatement request letter failed because it violated some basic tenets of communicating with the IRS. This is the second letter, which was successful in abating nearly $30,000 in late-filing penalties. This is a fantastic case study. I did not write the letter. It was written by the CPA who prepared the return, using my penalty manual.

Letters 8, 9, and 10 are the most recent and are some of my most powerful. All were completely successful in having the penalties abated, even in very difficult circumstances.

Letter #8 - A large organization was facing a $50,000 penalty. The CPA firm prepared the 2010 return and provided a copy to the organization. The CPA was supposed to e-file the return but failed to do so. The organization had already paid a late-filing penalty on the 2012 return. The penalty was so high because the organization was not notified of the non-filing of the 2010 return until several years had passed.

Letter #9 - A fairly large local youth sports organization had multiple problems with its Form 990 filings resulting in combined penalties of more than $30,000. Some returns were filed by the treasuer, others were filed by a professional tax return preparer (not a CPA). Schedule A's were not filed, multiple returns were filed after the due date, and many of the letters from the IRS were not responded to by the organization or the return preparer. The IRS had sent multiple letters of "final notice of intent to levy on certain assets." This letter is very complex and instructive and is a very valuable case study.

Letter #10 - An organization filed its return late for two consecutive years. It had a long history of filing returns on time and a long-standing relationship with its CPA firm. During the years in question, the CPA firm went through some technology changes and some personnel changes and failed to file extension requests on time.

Letter #11 - A public charity relied on a key volunteer to prepare the Form 990, but the volunteer was unable to file the return on time. We demonstrated that the volunteer was competent and reliable, but was overcome by excess responsibilities and personal health issues.

Letter #12 - This "letter" is actually designed to be an attachment to Form 1023 to explain why there was a reasonable cause for not filing returns for three consecutive years, which resulted in the loss of tax-exempt status. This statement conforms to IRS Revenue Procedure 2014-11 and is an actual statement that was successful in achieving retroactive reinstatement for a small 501(c)(3) association. The all-volunteer organization suffered from frequent turnover in directors and simply did not know of the filing requirement.

Abatement Letter Template in Several File Formats

After many requests, I'm offering a reasonable cause letter template you can use to structure your letter. This template is in several popular file formats including Microsoft Word format, so you can save it to your computer, open it, and get started on your letter (after you've studied the penalty manual, of course!)

One of the successful letters was written by a CPA (using the guidance from my e-book) who missed a filing deadline for one of his nonprofit clients AND the client had a prior history of late filing! $29,000 in penalties abated. He was kind enough to let me share his letter in my materials (letter #7 as described above). It's practically a case study all by itself.

Do NOT Send Money to the IRS!

Before you send that check to the IRS, and before you pick up the phone and call them, you need to read my penalty relief manual on how to get the penalties removed. In this 100+ page e-book I show you, step-by-step, how to write a successful "reasonable cause" letter to send to the IRS.

If you know what to say, and how to use the IRS guidelines on what constitutes "reasonable cause" for filing late, there is a very high likelihood that the IRS will remove the penalties. They do it all the time for those who know what to say and how to ask for relief.

My Form 990 Penalty Relief Manual

After helping many nonprofits get out of paying ridiculous penalties assessed by the IRS, and after seeing many nonprofits try and fail to have penalties removed on their own, I decided to write this special Penalty Relief Manual to teach you how to do it.

You can save hundreds of dollars in CPA fees by doing it yourself. And if you are a CPA, attorney, or other advisor to nonprofits and find yourself in a position of having to write such a letter (even if the late filing is your fault), this ebook is for you, so you can serve your clients better, and keep them happy!

Click here to buy the penalty manual, example letters, and video instruction now!.

Your purchase price includes one year of memberhsip access to all the materials and videos and any updates made during the year. Of course you can download copies of the penalty manual and the sample letters. They are yours forever.

What's in the Penalty Relief Manual?

|

100+ pages of explanations, techniques, special language, laws, and sample letters that I've used successfully many times. |

|

How the IRS calculates late filing penalties. |

|

What the IRS says about penalty abatement. |

|

What the Law says about penalty abatement. |

|

What to do immediately when your organization receives a penalty notice from the IRS because the Form 990 was late. |

|

What "reasonable cause" is. |

|

"Mitigating factors" and how they can save you. |

|

Learn about "events beyond the filer's control.". |

|

How to successfully blame your CPA or other agent. |

|

How you can show that you acted in a responsible manner by using the IRS's own language. |

|

Tips from the IRS Penalty Manual. |

|

What to do if the IRS rejects your return because it is incomplete. |

|

How, exactly, to analyze your situation, structure your letter and develop your argument. |

|

What to do if you are a CPA, attorney, or other advisor and your actions caused the late filing. |

|

Other nonprofit penalties that can be removed (abated) for reasonable cause.

Do You Qualify for Penalty Abatement? Not sure if your situation qualifies for "reasonable cause" abatement? Check out this list of nonprofit organizations I've helped get late-filing penalties removed to get an idea of the amazing variety of facts and circumstances the IRS will accept as "reasonable cause."

|

If your Exempt Status was Automatically Revoked, click here for information on retroactive reinstatement and reasonable cause.

This isn't a book of "tricks" known only to me, or special magic secret tactics or any of that hype. It is simply an organized and effective approach using the provisions of the Internal Revenue Code and other written guidance from the IRS. It works.

My ebook will help you write a strong argument that will make it easy for the IRS to see how your circumstances qualify for penalty relief under the law (or retroactive reinstatement, if applicable). One of the biggest problems I see in penalty abatement letters is that the organization fills the letter with information about what a wonderful organization it is and how many people it helps every year. The IRS does not care. Such a letter has a very low chance of success.

|

Here's one of the early success stories that inspired

me to write this book: The school president immediately responded to the IRS saying that the CPA they had hired to do the annual audit was supposed to have filed the 990, but didn't. The IRS, as usual, denied their request for penalty relief by saying that it was the organization's responsiblity to file, not the CPA's. In desperation they searched the internet and found me. I wrote a reasonable cause letter on their behalf, using the language and approach in this book, and the penalties were abated. The entire $20,000 penalty was removed. Like I said, it works. |

I've been writing penalty abatement letters for my nonprofit clients with great success for over 12 years. It helps to know how to speak the specialized IRS language. With this special manual, I teach you the approach I've learned over the last decade.

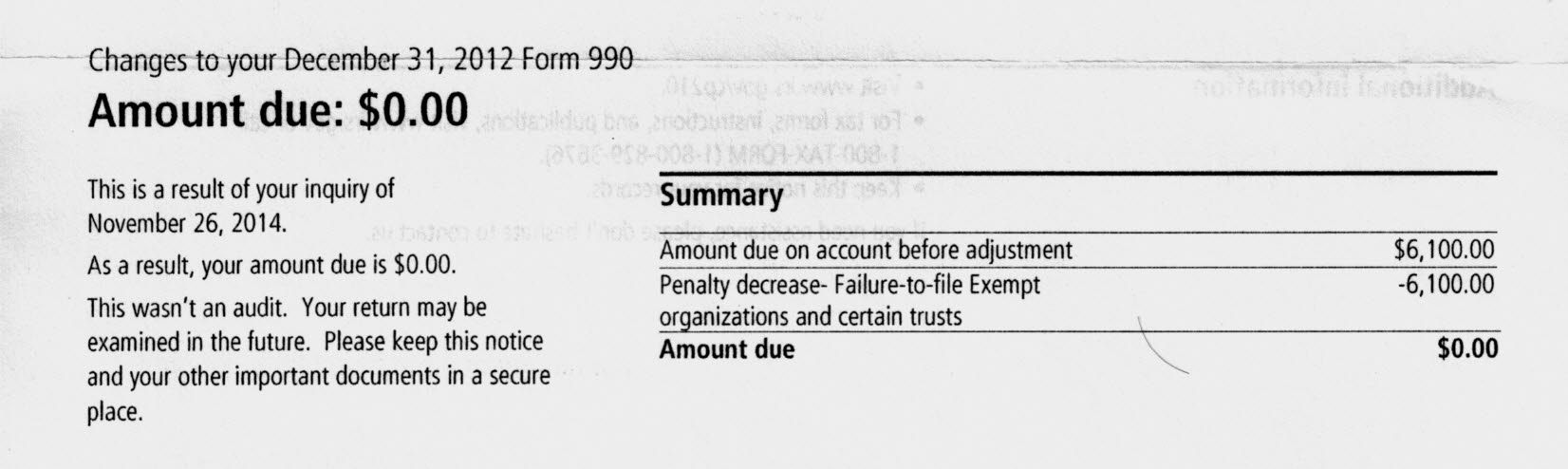

It's an INCREDIBLE RELIEF to get that letter from the IRS saying you now owe ZERO! Here's a cropped scan from one of my client's IRS responses showing a $6,100 penalty abated:

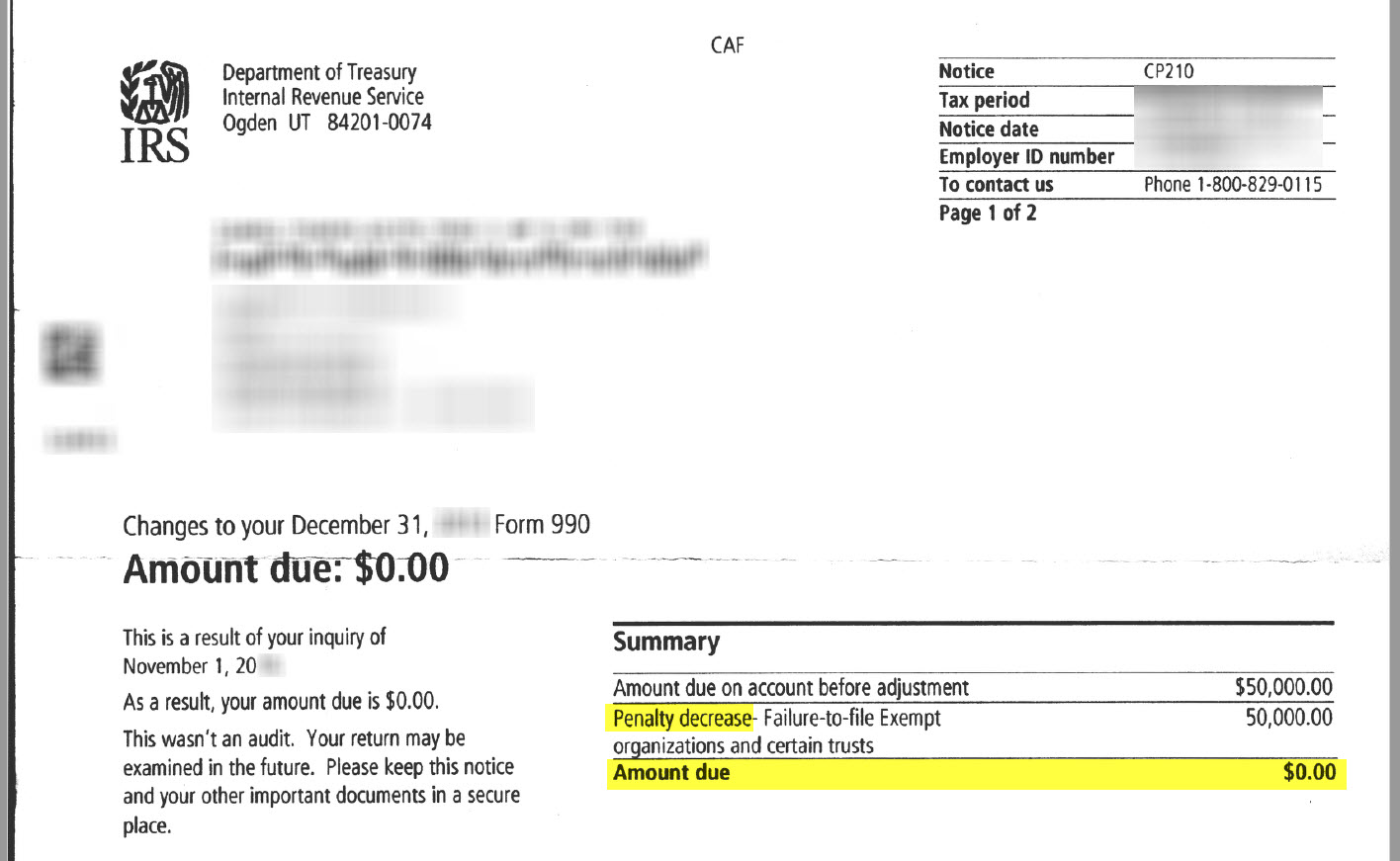

And here's another for a $50,000 penalty abatement! Do you think they were happy?

Testimonials from Clients

Just read a few of the unsolicited emails below that I've received from people who have used my Form 990 Penalty Manual or for whom I've written letters (yes, they are real). I know I should start asking clients for testimonials, that way I'd have more to show you, but I think it means more when they are unsolicited, like these:

Received February 26, 2021 from a California CPA after purchasing my penalty manual:

"Your materials were so thorough, it reminded me of studying for the CPA [exam] with Becker!"

Received May 13, 2017 from a nonprofit organization on the West Coast for which I wrote a reasonable cause letter for penalty abatement:

"Hi David. We just received written notice from the

IRS that [our organization's] 2015 Late Filing Abatement Process that you prepared and submitted for us was a

success. The $3,740 Late Penalty has been dismissed and removed from our account. Thanks so much for your

outstanding work. Let me know if you need a copy of the IRS notice for your file. Thanks Again, God Bless,

D."

Received December 29, 2016 from a Nonprofit Treasurer for whom I wrote a reasonable cause statement for retroactive reinstatement of tax-exempt status:

"Hi David, just in.... a Christmas miracle! (Attached IRS Letter.)

Received October 26, 2015 from a CPA who hired me to write an abatement request letter to the IRS:

"Dave, you did a great job putting that letter together. I have written them myself. I know it is more of an art form than a science, for sure. The all-important tone was excellent. You struck a good balance between the two extremes. I hope I don't need your services in the future, but if I do, I won't hesitate to contact you." --from D.H., a California CPA

Received January 27, 2015 from a CPA:

"I used your services for an abatement letter on 990 late filing back in October. I just wanted to let you know that the penalty was 100% abated with a savings of $16,700. Thanks for your help with this."--from Matt, a CPA.

Received July 24, 2014 from an Enrolled Agent:

"David McRee’s Form 990 Penalty Relief Manual for Do It Yourself Penalty Relief is well worth the money. I have used it successfully to achieve retroactive tax exempt status for a client in my practice. In particular the advise on writing the Reasonable Cause Letter is invaluable. Stop thinking about it and get the book today!" Ted Adams EA., Adams Tax Service, Granite City, IL 62040 618-791-8360.

Received July 25, 2013 from a CPA:

"...I have 100% successfully used the Abatement Petition method 3 or 4 times, which served to abate more than $16,000 in proposed penalties against my nonprofit clients." --from Charles D., a California CPA.

Received August 30, 2012 from a CPA who purchased my materials:

"Your web site, materials and work on this topic is absolutely amazing and I am super impressed. It is far better than Thomson Reuters or any of the national resource services that I consulted. I found you through a Google search and I am very impressed with your work." --from Mike, a CPA

Received August 7, 2012 regarding a letter I wrote on the client's behalf requesting retroactive reinstatement of tax-exempt status:

"Hi David, I just finished reading the attachment, and what a brilliantly written letter! You laid the argumeent out perfectly and I understand now what you meant about establishing a timeline. This letter flows so much better [than the one our CPA wrote]. I can really see the time and effort that you put into writing this letter, and I feel that my money was well spent. Regardless of the outcome, I will know that my best effort was put forth. I thank you again for your advice and expertise and I am cautiously optimistic! ... " from T.S., Exec. Dir. of a health clinic.

Received December 19, 2011

"Dear David,

I was devastated when one of our nonprofit clients received a $30,000 late filing

penalty. I did not know how to handle such penalties and did not know that they can be abated. With the help of

your Form 990 Penalty Abatement e-book I was able to get the entire amount abated. This ebook is full of great

and useful information for nonprofits. Due to the special circumstances of our case, our first abatement

attempt was rejected by the IRS. We contacted you via email and with your help and guidance the second letter

completely abated this huge $30,000 penalty. This book is for anybody who deals with IRS penalties as it has

basic and detailed information that is necessary to be successful in removing penalties." ---from L.I., CPA,

West Virginia.

Received March 8, 2011

I purchased your publication titled “Form 990 Penalty Relief Manual” a few months ago, and with the help of your publication, we were able to get $46,600 in failure to file penalties waived! This entity was formed about 15 years ago and had never filed a 990. We filed the last three years, one on time and 2 late. This was the penalty on 2 years filed late. (The entity went over the $1mil revenue mark in the second late year, so the penalty max was higher.) Thanks for your guidance! ---from M.H., a professional advisor.

Received November 16, 2010

"Dear Mr. McRee,

When I nervously opened the IRS envelope today, I could not believe my eyes! In

the amount owed box, this word appeared in capital letters: NONE!

We owe nothing! Thanks to you and your e-book, the IRS adjusted our penalty of

$2156.95 to nothing!

Thank you for your clear, practical and accurate advice. I had previously written

the IRS about the penalty.Their response was the penalty would stand. In researching what in the world to do in

the face of their response and dreading the severe impact the loss of a large amount of money would have on our

little non-profit charity, I came across your website and e-book. I wasn't too sure if a second letter to the

IRS about the same penalty would do any good, but your encouragement gave me a little sliver of hope. I pieced

together a letter based on your examples and verbiage and miracle of all miracles- it worked!

This was the best money I have spent in a long, long time and I highly recommend

to others- do not hesitate; buy this book, follow the advice and I believe you will have a greater opportunity

for a successful penalty abatement too.

Thank you again, Cindy."

Received October 29, 2010

"The IRS dropped all $22,000 in fines! Thank you so much for writing this informative and well-written book, and thanks for all of your assistance with writing the penalty abatement request letter -- we could not have done it without you. You really know your stuff, and it's clear that you really care about helping non-profits. Thanks, David!" - Patrick, Austin TX

Received August 2, 2010

I purchased your book by downloading it. It is a great investment! I used it to draft a letter for my client who had received a penalty in the amount of $6,000 for not filing their 2007 990 on time. ...Well it worked. They received a waiver for the $6,000 penalty and they are thrilled. So this really helped them, and I am now the hero...Thank you so much for your invaluable help. Monica

Received June 28, 2010

I am just following up with you on the outcome of the penalty abatement letter. We received a notice (CP210) abating all penalties! Thank you again for your guidance and assistance in reviewing my letter. Have a great day! Cindy

Received April 16, 2010

Just wanted to let you know that you can add [our organization] to your list of satisfied customers who received abatement from the IRS. We just received two letters notifying us that both penalties have been waived. Can't tell you how much we appreciate your assistance with this. You were a huge life saver. From Mike K., Treasurer of a youth sports organization.

Received July 16, 2009

Thank you, thank you, thank you.

I received penalty abatements for both clients. Before reading your book, I was

about to give up and just pay the penalties. The oversight that gave rise to the penalty was mine. There was no

one else to blame. I couldn't even blame the stress of the tax

season. Your book changed my outlook on the situation and provided

me with everything I needed to write 2 effective penalty removal requests.

One last thank you for the personal advise and email response to my questions.

Believe it or not, that alone was worth the price of the book. From Al.

Received April 2, 2009

Just wanted to let you know I received two letters from the IRS today abating over $10,000 in penalties. Thanks for your help, the information I received to write the letter requesting the abatement was extremely valuable. Thanks again. From Mark in NY.

Received August 25, 2008:

" Mr. McRee, thanks to you and your treatise on Form 990 penalty abatement, I've been successful in getting $37,400 in penalties abated! I seem short on words, but it's a tremendous feeling opening up the letter from the IRS, searching for the Amount You Owe box and seeing NONE. Let's see $37,400 divided by the book's price is about a 1,000 time return on the cost of your book. It's a great service you've provided for charities like ours. Have a great day. I know I will." from John J.

Received October 29, 2008:

"Before I purchased your "IRS Form 990 Penalty Abatement" I wrote what I believed was a reasonable letter to have the penalty abated. It was rejected. I incorporated some of the language you spell out and it was abated. My client is very happy with the results and I am both very happy and impressed. This is my most cost effective purchase EVER! Thanks, Donald V., CPA NYC

Received February 20, 2009:

First of all I want to thank you. I just talked to the IRS today and they have abated penalties for 2005 and 2006!!!!!!!!!! 2007 is under review and should also be abated. Your book was wonderful and really helped me with the correct language. It was the best $$$ our organization has ever spent.

Thank you very much for your advice. You have been very helpful to our organization. You really do provide a useful service to people who need it very much. I hope you understand what that means to organizations like us. From Steve, a professional advisor involved with a tax-exempt organization.

Click here now to buy the penalty manual, sample letters, and video instruction..

Your purchase price includes one year of memberhsip access to all the materials and videos and any updates made during the year. Of course you can download copies of the penalty manual and the sample letters. They are yours forever.

Money Back Guarantee: If you are not happy with the penalty manual, example letters, or video instruction, just let me know and I'll refund your purchase price. Note that I do not guarantee that the IRS will abate your penalty, although I'm available to help if your initial letter is not successful.

My friend, if you've made it all the way

to the bottom of the page without purchasing my materials, the only other thing I can think of to say to

you is that this book is absolutely the best advice and "how-to" information you'll find anywhere on

getting your nonprofit out of an IRS penalty. The only way you can do better is to have an experienced IRS

problem solver write the letter for you. I can do that. Use the links below to let me know you'd like my

help.

My friend, if you've made it all the way

to the bottom of the page without purchasing my materials, the only other thing I can think of to say to

you is that this book is absolutely the best advice and "how-to" information you'll find anywhere on

getting your nonprofit out of an IRS penalty. The only way you can do better is to have an experienced IRS

problem solver write the letter for you. I can do that. Use the links below to let me know you'd like my

help.

Having a problem? Contact David McRee, CPA (email form)

Request a phone consultation with David McRee, CPA (fee applies)